Contents:

Measure the distance between your entry point and where you placed the stop loss. Keep in mind all these informations are for educational purposes only and are NOT financial advice. Structured Query Language is a programming language used to interact with a database…. If you’d like a primer on how to trade commodities in general, please see our introduction to commodity trading. Indicator that changes the bar’s color to green if there is a Bullish Engulfing or Red if there a Bearish Engulfing Patterns.

You should consider whether you can afford to take the high risk of losing your money. The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend. This can leave a trader with a very large stop loss if they opt to trade the pattern. The first session of the pattern must be a red candle, thereby, validating that the market is still in a bearish mode. Whatever the interpretation of the case in point may be, more market traders are inclined towards buying as opposed to selling a specific stock instrument when this situation arises. Bullish engulfing is helpful when you are looking for stock reversals.

What Is a Candlestick Pattern? 9 Popular Candlestick Patterns Used … – MUO – MakeUseOf

What Is a Candlestick Pattern? 9 Popular Candlestick Patterns Used ….

Posted: Mon, 05 Dec 2022 08:00:00 GMT [source]

Typically, when the 2nd smaller candle engulfs the first, price holds support and causes a bullish reversal. In an up or bullish candle, the top marks the closing price, and the bottom marks the opening price. The high and low prices for the period may be indicated by thin lines that look like wicks of the candle and that extend beyond the real body. There are different types of candles, and the bullish engulfing and bullish engulfing candlestick charts are one of the most popular.

However, the closing price for G1 must be above the opening price for R1. One way to handle your portfolio during either a bull or bear market is with a free investment calculator. Such a tool can help limit the role of emotion in your investment decisions.

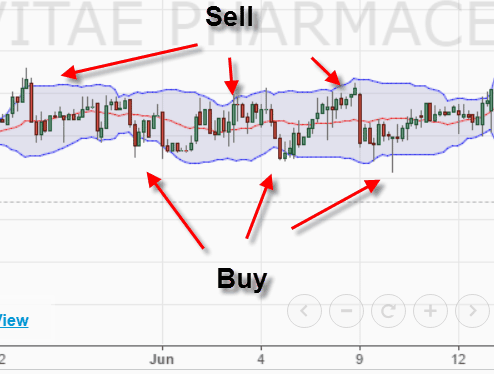

TRADE ALERTS “SIGNALS”

One should look for certain characteristics to spot this pattern on a candlestick chart. Individuals might choose to wait for another signal after this pattern formation. This sign is primarily a price break on the downward resistance line. Bullish Engulfing candle that considers the length of the candle and the position of the candle in a downtrend. Bearish Engulfing candle that considers the length of the candle and the position of the candle in an uptrend.

It offers the best signal when seen above an uptrend and shows a rise in selling pressure. The candle mostly causes a trend reversal, as more sellers are going into the market to drive prices further down. The pattern is made up of two candles with the second candle completely engulfing the previous green candle.

Engulfing Patterns – New Trader U

Engulfing Patterns.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

Simply put, we want to know the psychology behind the engulfing pattern. Before entering the trade, you must check whether the previous trend is a downtrend or not. As with any other trade setup, you will need to use money management to make things work out.

Intra-day Bullish Engulfing Pattern

When trading, you can use the three white soldiers as an entry or exit point. The underlying opens even lower in the next period, near the closing levels of the red candle formed in the previous period, and tries to set a new bottom. Do not take a trade in anticipation of a candlestick pattern formation. A bear marketis one in which the prices of securities in a key market index (like the S&P 500) have been falling for a period of time by at least 20%.

I will describe this trend as a bullish engulfment as long as it is fully engulfed. The key idea here is that you need to be very selective and only trade the engulfing pattern when it develops at extreme ends of a trend. Truth to be told, the engulfing pattern rarely develops at the end of a trend.

It is often seen as a sign to enter a short position in the market. When the bearish pattern appears, price action has to clearly show an uptrend. The big bearish candle means that sellers are aggressively going into the market. Traders will then look for confirmation that the trend is reversing. A candlestick shows the open-to-close range of every trading period. Its timeframe can vary from a second to a day or more – depending on the settings of the chart.

Pullbacks may move in the opposite direction of the trend or may just move sideways. The pullback should not drop below the low of the prior pullback, as this violates the rules of an uptrend. The pullback should not rally above the high of the prior pullback, as this violates the rules of a downtrend.

In the exhibit above a small green candle is followed by two red candles fully engulfing the body of the green candle. Traders use the bearish engulfing pattern to identify potential shorting opportunities, which may indicate that the market sentiment is changing from bullish to bearish. Bullish engulfing pattern is one of the most reliable patterns for traders, but it is not a guarantee of success.

Bullish Engulfing and Bearish Engulfing Patterns Used in Conjunction with Other Technical Analysis Tools

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and… Tradeveda.com is owned and operated by NERD CURIOSITY MEDIA PRIVATE LIMITED. Content shared on this website is purely for educational purposes. Trading and/or investing in financial instruments involves market risk. TradeVeda.com and its authors/contributors are not liable for any damages and/or losses caused due to trading/investment decisions made based on the information shared on this website. Readers must consider their financial circumstances, investment objectives, experience level, and risk appetite before making trading/investment decisions.

Will the Fed stop rate hikes? 5 things to know in Bitcoin this week – Cointelegraph

Will the Fed stop rate hikes? 5 things to know in Bitcoin this week.

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

After all, it is something that many traders are familiar with, and in the end, it works out more than it doesn’t. However, that is no reason to get aggressive just because the pattern kicks off. A candlestick contains an instrument’s value at open, high, low and close of a specific time interval. Sometimes, when the candles are too long, they can attract short sellers who may further down the asset.

We recommend using Intradayscreener.com ‘s Bullish Candlestick patterns and Bearish candlestick patterns screener to find out the same. If that does end up being broken to the downside, that could be a sign that the buyers have suddenly lost all control. The sellers of both candles are losing money and will have to buy back their positions to cover their losses.

What Is a Bearish Engulfing Pattern? Example Charts Help Explain This Indicator

Instead, traders will need to use other methods, such as indicators or trend analysis, for selecting a price target or determining when to get out of a profitable trade. A bullish engulfing pattern occurs after a price move lower and indicates higher prices to come. The second candle is a larger up candle, with a real body that fully engulfs the smaller down candle. A bullish engulfing pattern appears when a long white candle follows a shorter black candle.

- It helps you to choose to buy stocks immediately, or at the end of the second day, which is right after the reversal of market sentiment.

- In this case, the dominating bearish trend is overcome by the bullish pattern on the next day, giving way to a strong buying force.

- As we have already emphasised, what matters is not the number of candles, but the ability of the bears to “engulf” the bulls, thus showing market participants the readiness of sellers.

- With their colorful and clear representations of market data, they make it easy to see how the market has moved.

- A bearish engulfing pattern can be used to protect investments by providing an early warning of a potential bearish reversal.

The white should completely engulf the bearish candlestick from top to bottom. This means the top of the white candle should be above the top of the black one and the bottom of the white candle should be at or below the bottom of the black candle. Establishing the potential reward can also be difficult with engulfing patterns, as candlesticks don’t provide aprice target. Instead, traders will need to use other methods, such as indicators ortrend analysis, for selecting a price target or determining when to get out of a profitable trade.

This is how you have to look at open markets 24/7 because you do not get the gaps. You had seen a bit of selling pressure, followed by massive buying pressure. Sometimes, it’s essential to get the meaning of the candlestick instead of the same tick-for-tick action. What has been said so far for the bullish engulfing pattern is completely right for the bearish engulfing pattern, but in reverse order.

A bullish engulfing pattern is only a reflection of what is agreed upon by market participants. The one preaches that when both the body and the tails are engulfed, the strongest bullish engulfing pattern emerges. As a general rule, once we break the low of the bullish engulfing pattern, we should see momentum picking up to the downside. If we see this type of price behavior we’re almost sure we have got a good trade.

What is the Engulfing pattern?

It depicts a sign of stocks moving up, after a period of sluggish bearish runs. We will help to challenge your ideas, skills, and perceptions of the stock market. Every day people join our community and we welcome them with open arms. We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good.

And, secondly, https://trading-market.org/ needs liquidity to execute their big trades. In this regard, our goal is to identify price areas where the trading volume is flat. The apparent shift in the supply-demand balance is revealed by the second candle, which shows that the buyers have stepped in and managed to overcome the sellers. It provides you with a viable indication for your stock trading decisions irrespective of your stock trading style. Gold price struggles to defend early Tuesday’s corrective bounce around the $2,000 round figure as XAU/USD bears the burden of the US Dollar’s retreat heading into the European session.

To get a valid engulfing pattern, the first candle has to fit inside the body of the next candle. When the downward trend in prices is followed by a green candle that engulfs the red one of the previous day, it is suggestive of a reversal in the price trends. It means that despite the presence of bears, there are some optimistic investors, or bulls, who continue to buy the stock and finally manage to raise its trading price. A bullish candlestick pattern shows a reversal in the trend of stock prices, from a downward to an upward trend.

How to use the Bullish Engulfing Pattern while Trading?

If you have any questions or need bullish engulfing definition related to IQ Option trading, just ask me in any IQ Option articles in this blog. This candlestick shows the strength and overwhelming of the bulls . The last green candle covers and overwhelms all previous red candles. Bears have successfully overtaken bulls for the day and possibly for the next few periods. An evening star pattern is a bearish 3-bar reversal candlestick patternIt starts with a tall green candle, then a… If the candle is engulfed by a green candle on the following day, it might not necessarily result in a trend reversal.

- We’ll switch to section one, the bullish candlestick pattern that is engulfing.

- The negative share balance must be brought back to zero at some point by buying back the 100 shares.

- How to interpret the price manipulation around the engulfing bar.

- That’s the reason why you’ll see that, many times, the candlestick patterns failing more often than not.

A trader might want to purchase a financial asset a day after the two-candlestick pattern appears on the chart. When the candles appearing after the green candle have a higher closing price or if the red candle is a doji, the chance of a trend reversal is extremely high. In case you haven’t, here’s a quick graphical representation of the basic candlestick pattern. A reversal pattern like the bullish engulfing pattern needs confirmation of a reversal.

When the pattern forms, it is a gap lower, only to turn around and rise above the high of the previous candle. The example above shows a three-bodied bearish engulfing pattern. As agreed above, the number of candles does not matter as long as they engulf the previous candle. In other words, more market participants are willing to buy than to sell that particular instrument.